By the Reviews.com Team

The Best Homeowners Insurance Companies in Arizona

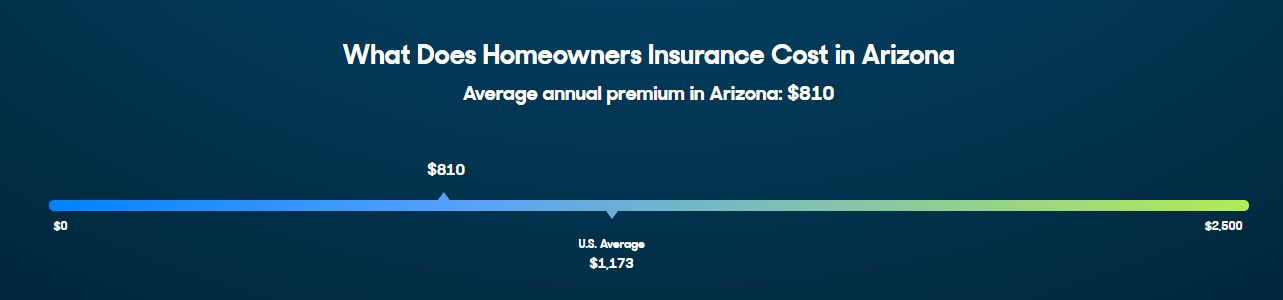

The weather in the Grand Canyon State is as beautiful as it is unpredictable. One minute there’s not a cloud in the big desert sky, and the next you’re experiencing what locals call “monsoon season.” Add in sporadic but costly hail storms, dangerous flash floods, wildfires fueled by scorching temperatures, and the occasional tornado, and researching insurance options can feel downright overwhelming. Whether you’re a native or a newcomer, finding the best homeowners insurance in Arizona should be easy and affordable. Good news: The average homeowners insurance premium in Arizona is $810 — considerably cheaper than the national average of $1,173. You can compare rates for your area using the quote tool above.

How We Found the Best Homeowners Insurance Companies in Arizona

We mirrored the approach from our review on nationwide homeowners insurance companies. First, we determined the largest home insurance companies in Arizona, then we took a look at their available discounts, add-on coverage opportunities, financial fitness, and claim handling. We called them up, emailed agents, and requested more than a few online quotes. Here’s how the top five stack up.

The Best Homeowners Insurance Companies in Arizona

- Liberty Mutual

- Allstate

- State Farm

- Farmers

- American Family

Arizona Homeowners Insurance Reviews

Liberty Mutual

Liberty Mutual nudged out Allstate and State Farm to take the top spot thanks to its consistent overall performance. Navigating the website was a breeze — we appreciated the Arizona-specific resources and easy-to-use tools, like the basic coverage calculator.

Behind Allstate, it offers the second highest number of discounts, giving customers a break when purchasing a new home, or after installing security and safety devices like deadbolts and fire alarms. Additional coverage options (often referred to as endorsements) range from building code upgrades to identity theft protection.

Liberty Mutual shines when it comes to attentive customer service. Of the five companies we considered, Liberty Mutual received the highest reader score in Consumer Reports’ national homeowners insurance survey, earning top marks for timely payouts and accurate damages estimates. Its emergency home repairs service offers 24/7 support, so if you find yourself standing in 2 feet of water at 3 a.m., you can have someone on-site before breakfast.

Liberty Mutual’s one flaw? The company isn’t as financially sound as some of its competitors (we’re talking an “A” compared to State Farm’s “AA” from Standard & Poor’s). Still, its rating was strong and given customer’s satisfaction with claims payout, it has a proven track record of coming through for its customers.

Allstate

When it comes to bells and whistles, there’s no match for Allstate. Our favorite feature — and one we recommend checking out regardless of the provider you choose — is the Common and Costly Claims tool. Using your zip code, it pulls the top five most common claims and expensive perils in your area, helping you to fill coverage gaps.

Allstate is the leader when it comes to discounts, and is particularly forthcoming about the exact amounts you can save. It offers 18 different ways to save and is also the only provider we surveyed that offers a welcome discount (10% off your premium for your first two years).

We were eager to hand the trophy to Allstate until we discovered that the company’s claims experience isn’t as stellar as its online presence. It tied with American Family for the lowest Consumer Reports’ reader score of our top picks and customers rated its payout amounts as “good” instead of “excellent.” Allstate did far better with J.D. Power’s consumer survey, scoring a 3/5 (the same as Liberty Mutual, American Family, and Farmers). Given its financial rating is the second highest of our picks (just behind State Farm), it’s worth getting a quote to see how much you can save. Just be aware that you may not get as big a payout in the event of a claim.

State Farm

State Farm has earned a reputation for its solid financial footing and knowledgeable agents. It was the clear favorite among Moody’s, A.M. Best, and Standard & Poor, receiving scores of “Aa1,” “A++,” and “AA” respectively. State Farm was also the only company in our group to receive a 4/5 from J.D. Power for overall customer experience, and it tied with Farmers for the second highest Consumer Reports’ reader score.

State Farm’s online user experience could be improved. It was hard to find a substantial FAQ section and the company doesn’t offer a home inventory app(you can log valuables via its online HomeIndex tool, but it’s not as convenient). However, on both occasions the we called looking for an answer we couldn’t find on the website, our wait was less than 5 minutes and the agents we spoke to were eager to help and never pressured us into getting a quote.

In terms of endorsements, it was on par with Allstate and Liberty Mutual, but had noticeably fewer discounts (the largest came from bundling your home and auto policies). While the company may not be the most digitally adept, State Farm is reliable and easy to reach, making it perfect for people who prefer to speak with an actual person and first-time home buyers who need additional guidance.

Farmers

In theory, Farmers is well rounded, but in reality it didn’t quite live up to the standard set by our other picks. Its discounts were average, except for a few niche options like a business or professional group discount and a retired military discount (although if you have military ties, we’d suggest looking at USAA, which ranks a full 10 points higher in Consumer Reports’ reader score).

The Farmers website felt slightly outdated and it doesn’t offer a home inventory app, but its virtual home tool was educational and fun to use. By clicking on items in the home, it answered questions we didn’t even know to ask, like, “In the event of a power outage, is the food in my refrigerator covered?” (Answer: Yes!) As far as financial stability goes, Farmers garnered an “A” rating from both A.M. Best and Standard & Poor’s.

Despite receiving an average score of 3/5 from J.D. Power for overall customer experience (the same as Liberty Mutual and Allstate), our initial interaction was second-rate. When we called, we either faced a disgruntled agent or ended up conversing with a computer — and neither adequately answered our specific questions. Despite falling down on customer service, if you qualify for some of Farmers discounts, it’s worth pulling a quote to compare premiums.

American Family

We likely would have ranked American Family higher had we been able to glean more information. It tied with Allstate for a Consumer Reports’ reader score of 80, received a 3/5 overall from J.D. Power, and fell between State Farm and Liberty Mutual when it came to financial security.

If you’re into home automation (think smart phone-controlled thermostats and doorbell cams), you’ll love American Family’s focus on having a “Smart Home” and could save up to 5% on your premium. It also offers a unique generational discount if your parents are existing customers. However, the company’s endorsements are overall pretty limited — added coverage for particularly pricey valuables (like a wedding ring) and extra coverage in case of sewer backup are noticeably missing.

American Family’s downfall lay in how difficult it was to get answers to some of our most basic queries. Online quotes are only accessible if you enter your social security number (not ideal for security reasons, especially without a contract in place). When we called the company directly, we spoke with a call center agent who struggled to answer straightforward questions like, “Do you offer a discount for bundling multiple policies?” Turns out, local agents are your best bet for detailed information from American Family. We always encourage customers to gather multiple quotes, so don’t discount this provider until you’ve had your own experiences. But be sure you consider other policies alongside this one.

Guide to Homeowners Insurance in Arizona

Look beyond your quote

Upon first glance, two quotes we received on a $173,000 home in Tucson appear to be within close range of each other. State Farm and Allstate even quoted us the same monthly premium. But after taking a closer look, it’s clear each quote varies significantly in coverage and price.

The property coverage amount included in Allstate’s $66 monthly premium is $3,000 short of the home’s current value (replacing a home after a fire or natural disaster can cost even more). And while State Farm offers $30,000 more in property coverage at the same monthly premium, it also offers $100,000 less in personal liability cover. The deductible is also $1,000 higher than Allstate’s.

The takeaway? Online quotes are convenient and give you an idea of the types of questions the provider is likely to ask — What kind of dog do you have? When was the last time your roof was replaced? Do you own a fire extinguisher? — but when it comes to accuracy and being able to easily customize your quote, nothing beats a good old fashioned phone call to talk through every component of your policy and make sure you’re getting the coverage you need.

A dry year for Arizona

There’s no denying 2017 was a hot one for Arizona. In Phoenix, flights were canceled due to sweltering 120-degree temps, Tucson reported its hottest year on record, and mailboxes reportedly melted in Mesa. So, what’s this got to do with homeowners insurance?

Extreme heat often goes hand-in-hand with drought, and then it only takes one wayward spark or bolt of lightning to ignite a wildfire capable of torching half a million acres (see 2011’s Wallow Fire, which resulted in the evacuation of nearly 6,000 people and the loss of 32 homes.) Following a burn, a lack of vegetation and soil erosion makes it so that the earth is unable to absorb rain and runoff, thus leading to an excess of water with nowhere to go.

Even areas that are typically low-risk are susceptible. The Arizona Department of Emergency and Military Affairs estimates that up to 25% of all flood insurance claims come from low-risk areas, and this NASA study specifically calls out Phoenix, where monsoon season is getting worse. In early 2018, scientists were already predicting extreme droughts in southern and central Arizona.

If you’re anything like us, your first reaction might be to Google whether damages incurred from wildfires are covered under most homeowners insurance policies. Unsurprisingly, our top pick, Allstate, addresses the issue in depth. According to its website, the answer is (usually) yes: “Standard homeowners policies generally help protect against specific perils, or certain causes of loss, such as theft and fire, but coverage may vary by geographic location and by policy. You may also find that some insurers do not sell homeowners policies in areas where wildfires are common.”

Double check with any prospective providers before you sign on the dotted line.

Arizona Homeowners Insurance FAQ

How much is homeowners insurance in Arizona?

Arizona’s average annual premiums for homeowners insurance are below the national average — $810 per year for an HO-3 policy, compared to $1,173 nationwide. That said, how much you’ll pay can vary a lot depending on your home’s size, your assets, and your address. Use our tool to find your best rates.

Do I need flood insurance in Arizona?

Despite Arizona’s dry climate, floods are a common natural hazard and you’ll want to consider adding flood insurance to your homeowners policy. Between 2000-2010, Arizona faced five federally-declared flood disasters. You can discover your flood risk by entering your address on FEMA’s Flood Map Service. Liberty Mutual, Allstate, and Farmers offer their own flood insurance, while State Farm and American Family partner with the National Flood Insurance Program.

The Best Homeowners Insurance in Arizona: Summed Up

Recent Comments